The National Fisheries Institute (NFI) recently hosted the 11th anniversary of The Global Seafood Market Conference (GSMC) from January 16-20, 2023, in Palm Springs, California. GSMC is an annual conference that offers high-caliber insights into trends and provides expertise on seafood products, markets, and consumers.

Savanna Ronco, Seattle Fish Company’s Marketing & Brand Specialist, attended the conference, held at the La Quinta Resort in Palm Springs. Savanna is an active member of NFI’s Communications & Education Committee and will be participating in the NFI Future Leaders program in 2023.

This year’s GSMC agenda featured many expert speakers from both inside and outside of the seafood industry – shedding light on relevant topics such as retail, food service, economics, freight, and other sectors. While the seafood industry will continue to be unpredictable throughout 2023, Seattle Fish Company will continue to collaborate with NFI and other industry partners to voice current challenges and develop solutions.

Below are a few key takeaways from the 2023 GSMC Conference:

1 – Consumer buying power is shifting to “younger” Americans.

A big topic of conversation at this year’s GSMC was that Millennials and Gen Z now make up over 40% of the US population. According to the US census, by the year 2030 half of all Americans will be Millennials, Gen Z, or younger. Chris DuBois, EVP and Practice Leader at IRi, suggests that a massive change is coming, as the younger generations begin to hold most of the buying power both in retail and foodservice. For seafood in particular, IRi has noticed that millennials are purchasing much less seafood than boomers, and the climate is “ripe to embrace new ways to drive demand”, including more demand for storytelling, informational display cards or QR codes, or cooking instructions with health benefits.

Kelly Fecher of Datassential shared that 67% of Gen Z consumers have taken a video of a dish at a restaurant or meal at home and shared to social media. As the buying power shifts to younger Americans, they will relate to restaurants and retail stores that engage with them on social media, and many state that they would go to a restaurant they’ve never been to specifically to try a dish they saw online. Additionally, video sites like Instagram and TikTok continue to drive new food trends, like the butter boards that went viral in 2022. Fechner reported that 76% of consumers are excited about new food & beverage trends in 2023 and 74% of restaurant operators say that new food & beverage trends will be important to their business in the upcoming year.

2 – “Transparency is the cornerstone of trust in food.”

Mickie French, Executive Director of The Center for Food Integrity, spoke about “Changing the Tide on Consumer Trust”, saying that “Trust is every organization’s most valuable intangible asset.” French shared that “shared values are 3-5 times more important to building trust than sharing facts or demonstrating technical skills/expertise.” According to Richard Barry of NFI, this isn’t a “clear cut win for seafood” because the industry has so much information to share, which makes it all the more important that seafood companies and distributors act as a trusted source of information and a valuable partner to consumers.

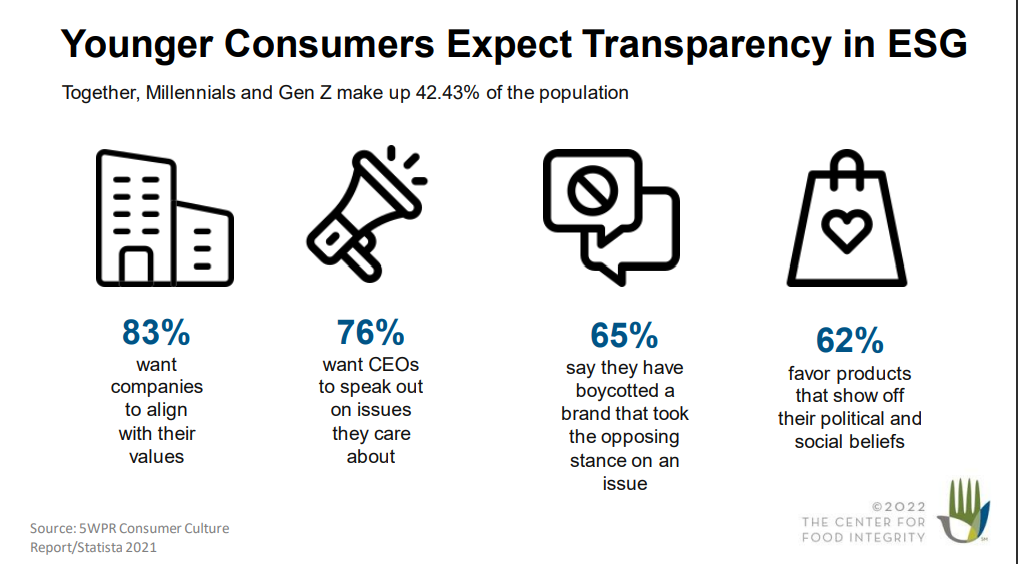

French stated that younger consumers, in particular, expect transparency in their food system, with 83% wanting companies that align with their values. Additionally, Gen Z consumers are taking a more holistic approach to food & health and are the only generation putting mental health in the Top 3 benefits sought from food, beverage, and nutrients. Her suggestions for the seafood industry were to embrace the skepticism, share why you care (which is as important as what you know), and don’t overload people with facts, instead focusing on the most important information in addition to shared values.

3 – GSMC 2023 Insights & Trends

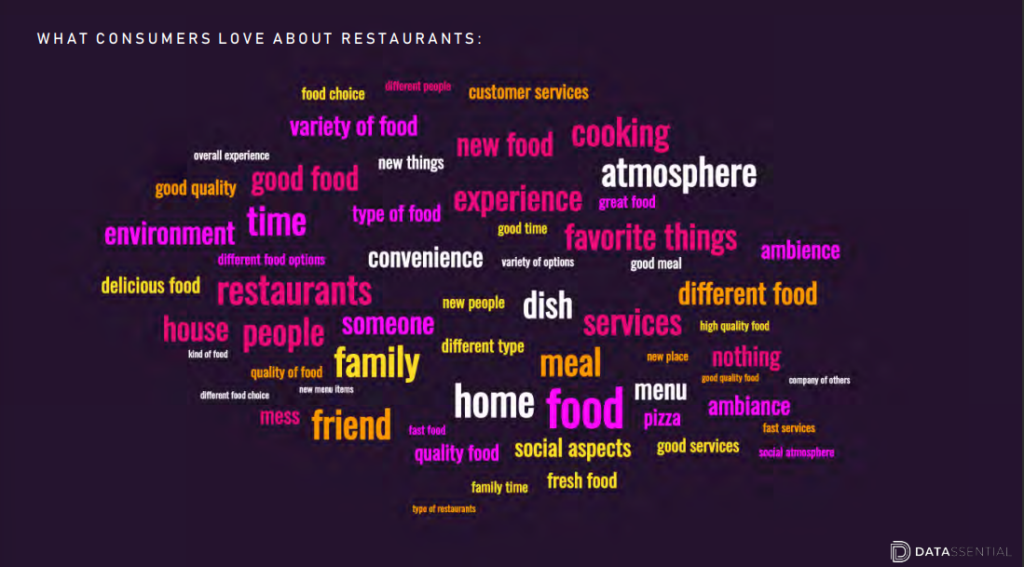

Fechner of Datassential shared that 32% of consumers say they’ll never visit restaurants as often as they did before the pandemic, which is understandably concerning for many people in the hospitality industry. This could be for a number of reasons, including the surprising “staying power” of working from home, as well as people moving from the cities to the suburbs, or from the suburbs to a more rural area, as a result of the pandemic. She suggests that operators will have to “step up their game” to win these consumers back. One of the ways she’s seen restaurants do this is by adding items to your menu with high “purchase intent” and “draw”, meaning an item that people come to your restaurant specifically to enjoy, like Joe’s Crab Shack’s “Build your own Boil”.

Labor and staffing continue to be a major issue for the hospitality industry, particularly in foodservice. Chef Andrew Gruel of Calico Fish House in California shared on a panel that the labor challenges have resulted in him considering and testing value added products for the first time as a chef to alleviate some of the burden on his back-of-house staff. Michael Brennan of Specialty Restaurants Corporation agreed, adding that his group is also testing 4-day work weeks, daily staff meals, and extra incentives for management.

Steve Sands, President of Protein Brands at Performance Food Group, did a presentation on “Markets and Marketing Trends in Animal Protein”, which focused largely on the comparison between premium beef and seafood. Sands said, “Even though beef is by far your most expensive protein, it is not slowing down people’s consumption.” One of the reasons for this is that beef is “far ahead of other proteins” on branding and telling a story. However, with the widespread drought in 2022, the USDA is predicting a drop in beef output in 2023, up to 9% in Q3 and Q4. This means that operators need to be prepared for increased costs as well as thinking “outside of the box” on other proteins to fill the void.

Savanna recommends:

- Connect servers and diners with your food & ingredients. Data shows that now, more than ever, consumers are interested in where their food comes from. They want to know the story behind the dish you are serving or ingredients you choose, what family farmers they might be supporting, or what social/environmental impact they are making by choosing to support your restaurant or retail store. Encourage your diners to share stories or videos online with a tag to your restaurant so you can repost.

- Take a look at the biggest uses of labor in your operation and evaluate which brings benefit to the customer, and what might be outsourced with no loss of value. Create space to experiment or research options that you may not have considered in the pre-pandemic world, such as changing portion sizes, labor scheduling, specials, value added products, etc.

Understanding how shoppers and diners engage with seafood and other proteins, the forces that shape that engagement, and how external forces impact our industry will continue be important. Look for Seattle Fish Co. to continue to invest in industry leadership that shapes our marketplace, keep our pulse on the trends as well as important information you need, and share this with you in a meaningful manner.